2019 Saudi Arabia Healthcare Industry Overview

Towards the healthcare goals of Saudi Vision 2030

A report by Global Health Exhibition

Market Overview

Healthcare remains a top priority for the government in the Kingdom of Saudi Arabia (KSA), and there are enormous opportunities for growth in this high-potential business sector.

In line with the government’s Vision 2030 and the National Transformation Program (NTP), the Ministry of Health (MoH) is expected to spend close to US$71 billion over five-years ending in 2020. According to US-based consultancy Aon Hewitt, the healthcare sector in KSA is expected to grow at a compound annual growth rate of 12.3% by 2020. There is also a significant rise in population with an increase in those over the age of 60 years, as well as the adoption of mandatory health insurance in the country.

To increase efficiencies and reduce costs, the government in KSA has actively explored private sector involvement in the development of the healthcare infrastructure in the Kingdom. By introducing Public-Private Participation (PPP) models for healthcare, the government is working towards unlocking value in the health system and fast-tracking healthcare reform with plans to increase private sector contribution in total healthcare spending to 35% by 2020.

Meanwhile, technology also remains a core factor in upgrading the KSA healthcare sector in the coming years with information technology playing a pivotal role in offering solutions related to cost, quality, access and resources.

Increasing the availability of a skilled workforce in healthcare is also emerging as a significant focus for the Kingdom. Major efforts are underway to provide educational and training facilities for doctors, nurses and paramedics through the expansion of new medical colleges.

Top Line Healthcare Stats For KSA

- 77.2 million people by 2050

- 70% of population below the age of 40 years

- Life expectancy is expected to increase to 78.4 (males) and 81.3 (females) by 2050

- NCDs accounted for 68% of all deaths

- Government’s vision 2030 and NTP focuses on healthcare development

- 15.6% of 2019 budget allocated to healthcare

- Foreign investors can have 100% ownership in healthcare sector

- 295 hospitals and 2,259 healthcare centres to be privatised by 2030

- 13,700 doctors required by 2030

- 20,000 additional beds required by 2035

Source: World Bank, WHO, KSA MoH, Colliers International, Knight Frank

The 2019 Budget For Healthcare

In a review of KSA’s 2019 budget and recent economic developments, KPMG has highlighted that the healthcare sector holds the third largest share of 15.6% in the budget expenditure of 2019. The budget allocation for the sector has grown by 8% to reach SAR172 billion in 2019, as compared to SAR159 billion in 2018.

Public spending on the healthcare sector is largely channeled towards new initiatives, such as increasing the life expectancy, reducing obesity and localisation of pharmaceutical manufacturing. The government is also diverting the funds towards creating a robust healthcare infrastructure by building new hospitals.

Saudi Vision 2030 And The National Transformation Program

Healthcare is one of the main focus areas of the Kingdom’s Vision 2030 and the National Transformation Program. According to a report by Knight Frank, the main goal of the Vision 2030 is to diversify the economy away from hydrocarbons and achieve greater participation of the private sector by encouraging both local and international investments in several key industries such as healthcare. Privatisation of government services is expected to help meet the goals set out in Vision 2030 to increase the private sector’s contribution to GDP from 40% to 65% in 2030.

The NTP, which was developed to help fulfill the Vision 2030, has identified a number of key targets to be met by each government body by 2020. The Kingdom’s healthcare plan under the NTP has placed the sector on a fast trajectory to privatisation and growth over the coming years.

Privatisation is seen as a key focus area in the Saudi Vision 2030 and the NTP. As outlined by Knight Frank, the strategic objectives stated for healthcare in the NTP include:

- Privatisation of one of the medical cities through a PPP scheme

- Increasing private sector share of spending in healthcare through alternative financing methods and service providers

NTP targets for the ministry of health for 2020 include:

- Increasing private healthcare expenditure from 25% to 35% of total healthcare expenditure

- Increasing the number of licensed medical facilities from 40 to 100

- Increasing the number of internationally accredited hospitals

- Doubling the number of primary healthcare visits per capita from two to four

- Decreasing the percentage of smoking and obesity incidence by 2% and 1% from baseline respectively

- Doubling the percentage of patients who receive healthcare after critical care and long-term hospitalisation within four weeks from 25% to 50%

- Focusing on improving the quality of preventive and therapeutic healthcare services.

- Increasing focus on digital healthcare innovations

Source: Healthcare In Saudi Arabia Opportunities In The Sector, May 2018, Knight Frank

Supply & Demand

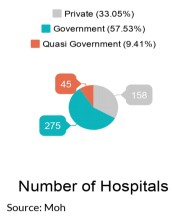

In terms of supply, both private and public hospitals in KSA provide almost the same services; however, what differs is the capacity, quality, waiting time and most importantly, efficiency. As outlined in a recent research paper by Al Rajhi Capital, private hospitals provide a range of quality services to their patients including backup analytics, with a full medical experience but at a high cost.

The authors of the paper believe that this supply dynamics may change in the long run as the government is encouraging the private sector participation in the healthcare sector as the public sector’s role is gradually transitioned to becoming more of a regulator rather than as a provider of healthcare facilities, as highlighted in the NTP and the privatisation plan.

For Saudi citizens, the demand for healthcare services through private hospitals focuses more on treating medical cases such as seasonal illnesses, minor fractures, delivery surgeries and cosmetic treatments, largely on the back of the pool of experienced doctors, coupled with lesser waiting time. On the other hand, the importance of government hospitals is mostly for the treatment of severe medical conditions, for an example, Cancer, Internal Medicine and Ophthalmology. Nonetheless, those, who can afford the treatment, either cash or insurance coverage, prefer to go to private hospitals, the paper outlines.

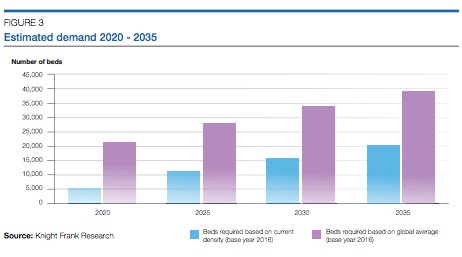

Demand For Bed Space

According to Export.gov, the public sector dominates the supply of healthcare services in KSA and accounts for the majority of healthcare expenditures. The public healthcare sector represents approximately 79% of bed capacity. Industry sources expect the private sector to grow at a faster pace than the government sector, enhanced by the latest government policies to encourage more private sector involvement in the provision of healthcare services.

Meanwhile, research from Knight Frank indicates that to keep pace with population growth, Saudi Arabia would require an additional 5,000 beds by 2020 and 20,000 beds by 2035, based on the current density of beds. Based on the global average of bed density, Saudi Arabia faced a gap of 14,000 beds in 2016, and this gap is expected to widen to 40,000 beds by 2035.

With life expectancy of both males and females on the increase, Colliers International expects this to create demand on long-term care (LTC) facilities, focusing on geriatric related care, rehabilitation and home healthcare services.

Based on current international benchmarks of 4-6 beds per 1,000 population above 65 years, Colliers International estimates that KSA currently needs between 6,400 - 9,600 beds dedicated for LTC. This is expected to reach 41,200 – 61,800 LTC beds by 2050.

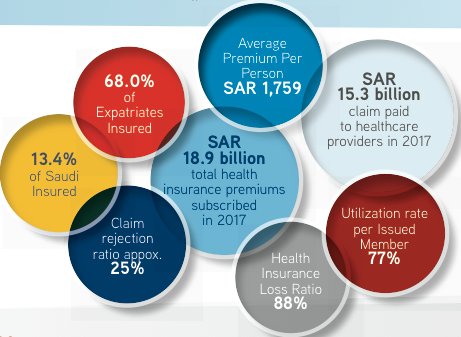

The Rollout Of Mandatory Health Insurance

KSA began implementing the mandatory unified health insurance scheme in July 2016, with the system fully in place in 2017. According to Knight Frank, the rollout of the Mandatory Health Insurance (MHI) to private sector employees in Saudi Arabia took place in various stages.

MHI PHASES:

- Phase 1: Starting July 2016 - targeted companies with more than 100 employees.

- Phase 2: Starting October 2016 - targeted companies between 50 and 99 employees.

- Phase 3: Starting January 2017 - targeted companies between 25 and 49 employees.

- Phase 4: Starting April 2017 - targeted companies with less than 25 employees.

Source: Healthcare In Saudi Arabia Opportunities In The Sector, May 2018, Knight Frank

According to the Council Of Cooperative Health Insurance (CCHI), which is an independent government body built to regulate the health insurance in KSA, all KSA employers in the private sector are required to use one health insurance policy as of 1 July 2018 to cover their Saudi and non-Saudi employees and their dependents.

As of December 2018, there are 27 insurance companies are operating in Saudi Arabia and the number of insured persons in the kingdom stood at 10,801,693 including over one million Saudi employees along with over 1.77 million of their dependents. Meanwhile, over six million expatriate employees were insured along with over 1.9 million of their dependents.

The new regulations are expected to add another two million people to the overall number of insured persons by the end of 2019.

Source: Kingdom of Saudi Arabia Healthcare Overview, The Pulse: 8th Edition, 2018, Colliers International

Medical Devices

According to Export.gov, the KSA market for medical equipment is estimated at just under US$2 billion and is growing annually at roughly 10%. With increasing awareness of health issues and a growing consumption of healthcare services in the country, there is a strong market for medical equipment.

Encouraged by recent regulatory changes, medical device manufacturers, service providers and dealers & distributors are now able to make significant inroads in the KSA market.

The recently introduced Medical Device Interim Regulations has made the Kingdom a regulated market for all types of medical devices and all manufacturers wishing to supply a medical device within KSA require Saudi Food & Drug Authority (SFDA) Market Authorisation.

Why Invest in KSA?

According to Colliers International, the key factors that make KSA’s healthcare market attractive are:

- THE STRUCTURE – The KSA healthcare structure is structured to provide basic healthcare services to all with specialised treatment offered at both private and public hospitals.

- THE POPULATION BOOM – With the World Bank estimating the KSA population will reach 45.1 million by 2050 (from an estimated 32.6 million in 2018), the demand for healthcare services is expected to grow exponentially.

- THE RISE OF THE PRIVATE SECTOR – As the public sector is gradually transitioning to become more of a regulator, private players are being incentivised to play a larger role in the healthcare sector. Foreign investors can now have 100% ownership in the healthcare sector.

- THE POWER OF PPPs – The government continues to invest in the development of healthcare infrastructure with various medical cities under construction. The private sector is expected to act as operators in the form of PPPs.

- THE BUDGET INCREASE – The annual increase in budget allocation towards healthcare social services in KSA reflects a strong indication of potential demand as well as the government’s willingness to augment growth and improvement within the sector.

Future Opportunities

The healthcare sector in the Kingdom has witnessed collaborative progress over the years and, as a result, industry experts foresee a significant upward trend for the industry in the next three to four years.

According to analysis by Colliers International, the following opportunities exist in the KSA healthcare sector:

- DEMAND FOR PRIVATE HEALTHCARE – Year-on-year, the volume and share of the private sector, has been increasing.

- INCREASED DEMAND FOR HEALTHCARE QUALITY - KSA’s healthcare facilities in general, and Riyadh and Jeddah, in particular, are accredited by international healthcare accreditation bodies such as JCI and ACHSI.

- LONG TERM CARE/ REHABILITATION - With the changing age profile, KSA requires a large number of LTC facilities.

- DAYCARE SURGICAL CENTRES - Due to advancements in healthcare technology and the increase in the prevalence of lifestyle diseases, there is a higher demand for daycare surgery centres.

- DEMAND FOR MATERNITY AND PAEDIATRICS - Private health facilities in KSA are focusing on maternity and paediatrics owing to high demand for these specialties.

- INCREASED DEMAND FOR SPECIALISED SERVICES - Centres of excellence focusing on certain specialties are expected to grow further, especially in Riyadh and Jeddah.

- LABORATORY AND DIAGNOSTIC CENTER - Standalone laboratory and diagnostic centres are required in KSA to support the increasing volume of outpatient facilities.

- PRIMARY CARE - Owing to the large population in the KSA and high occupancy rates of the hospitals, the country requires more primary care clinics and medical centres to meet the demand of the rising population.

- RELIGIOUS TRAVEL – The country plans to welcome 30 million pilgrims by 2030, and there are 25 hospitals and 158 health clinics across the holy cities.

Latest Infrastructure And Project Updates

Royal Philips, a global health technology firm, has announced it has teamed with the KSA MoH to provide a cardiovascular information system (CVIS) across multiple facilities. Under the Taji project, patient medical information will be available on demand at the point of care in each one of the connected hospitals to help improve quality access to cardiology care managed by a network of specialists.

In 2018, it was announced that the KSA MoH would establish a holding company and five regional companies under plans to privatise the healthcare sector. Plans will allow full foreign ownership in the health sector, so the ministry will become a regulator and not a service provider. The Kingdom eventually plans to privatise 290 hospitals and 2300 primary health centres by 2030.

In 2019, NMC Health finalised a joint venture agreement with Saudi Arabia’s General Organization for Social Insurance that includes up to SAR6 billion of investments in the Kingdom over a five-year period. The joint venture will acquire and develop facilities with a capacity of up to 3,000 beds and employ up to 10,000 full-time and part-time employees.

GE Healthcare has announced a partnership agreement with Tatweer Medical Co., an investment arm of Tatweer Holding, to develop an advanced diagnostic facility in what is expected to become one of the largest specialised private medical campuses in the Kingdom. The Medical Village project, announced in 2018 and set to open in 2020 near Riyadh’s Diplomatic Quarter, will host seven specialised hospital buildings with more than 900 beds and 33 stand-alone medical centers delivering high-quality care across all areas of specialisation.

References:

Kingdom of Saudi Arabia Healthcare Overview, The Pulse: 8th Edition, 2018, Colliers International.

Investment big bets: health care and life sciences in the GCC, EY.

GCC Healthcare Industry, March 26, 2018, Alpen Capital.

Kingdom of Saudi Arabia Budget Report: A review of KSA 2019 budget and recent economic developments, December 2018, KPMG.

Healthcare In Saudi Arabia Opportunities In The Sector, May 2018, Knight Frank.

https://2016.export.gov/industry/health/healthcareresourceguide/eg_main_108615.asp

http://www.alrajhicapital.com/en/research/Economicother/Saudi%20Healthcare%20Industry%20Dec%202018%20English.pdf

_page-0001.jpg)

.png)